Article

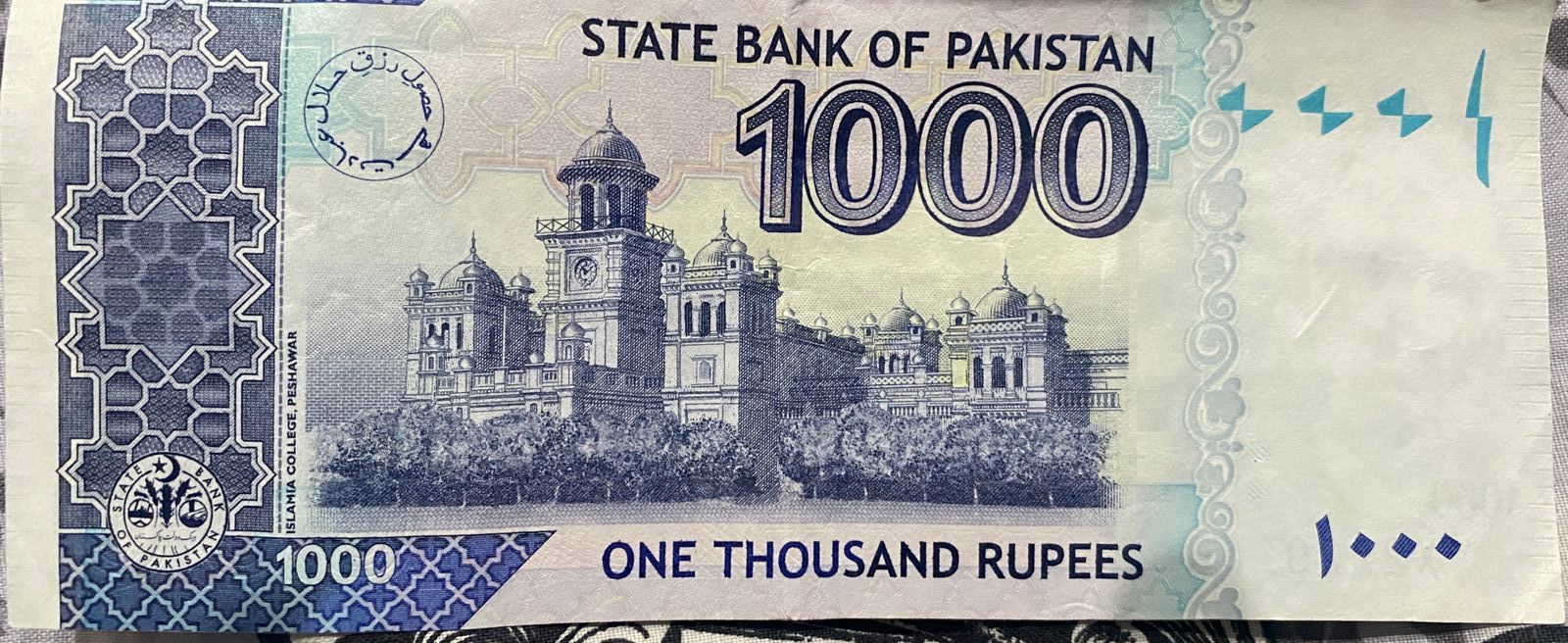

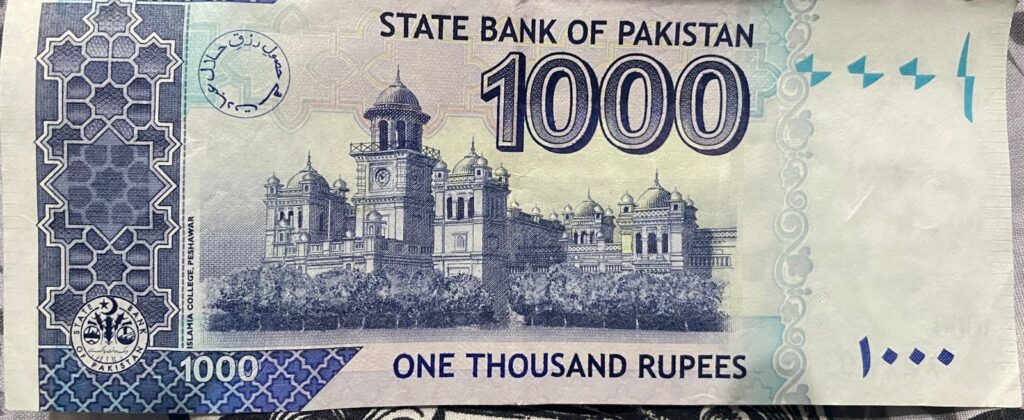

On August 12, 2025, the Federal Board of Revenue (FBR) issued Circular No. 02 of 2025-26 (Income Tax), formalizing a Rs. 200,000 ceiling on cash payments for retail transactions and e-commerce Cash-on-Delivery (CoD) orders. The rule extends the existing cash-transaction limit applied at physical retail outlets to online CoD shipments — a clear push by the government to accelerate Pakistan’s transition toward a cashless economy. FBR Download CenterBusiness Recorder

Why the change was made

According to the FBR and subsequent reporting, the limit aims to encourage digital payments, increase transactional transparency, simplify payment tracking, and help curb tax evasion. For tax authorities, reducing high-value cash movements makes monitoring and auditing easier; for policymakers, it’s a structural step toward broader digital financial inclusion. FBR Download CenterTechJuice

Who this affects

The new limit applies to:

- E-commerce companies that offer CoD as a payment option (orders paid in cash at delivery), and

- Consumers who still prefer paying in cash for high-value online purchases.

Merchants and logistics partners will need to reject or split any single cash payment that exceeds Rs. 200,000 and must offer or encourage alternative payment channels for higher-value sales. ProPakistaniHUM News

Practical implications for merchants

E-commerce businesses should immediately check and update checkout and delivery procedures:

- Payment validation: Ensure order-management systems flag CoD orders above Rs. 200,000 and trigger alternative flows (e.g., prepaid, bank transfer, card, or mobile wallets).

- Customer communications: Add clear messaging on product pages and during checkout about the Rs. 200,000 cash limit to reduce rejections at delivery.

- Logistics training: Prepare delivery staff with scripts and procedures for handling capped CoD transactions (e.g., refusal, partial payment not accepted, or payment collection alternatives).

- Accounting & reporting: Reconcile CoD receipts carefully; the limit reduces exposure to cash-handling risk and tax penalties under the Income Tax Ordinance. FBR Download CenterProfit by Pakistan Today

What buyers should do

If you prefer cash, plan ahead:

- Use digital payment methods (cards, bank transfers, mobile wallets) for purchases above Rs. 200,000.

- For high-value items, contact the seller before checkout to arrange an acceptable payment method.

- Expect some sellers to remove CoD for expensive items altogether or require partial advance payment. TechJuicePkrevenue.com

Broader context & potential friction

This circular follows earlier tax changes that already discouraged large cash sales — such as disallowance rules for business expenses linked to cash sales above Rs. 200,000 — and has prompted debate about compliance costs for SMEs and logistics providers. Some businesses have reported operational challenges adapting to similar rules introduced earlier in 2025. Policymakers argue these measures are necessary for better tax collection and financial transparency, while some merchants warn about short-term disruptions and customer pushback. Business Recorder+1

Action checklist (for e-commerce teams)

- Update product, checkout, and CoD policies to enforce the Rs. 200,000 cap.

- Add payment alternatives visibly on product pages.

- Train delivery teams and customer support on the new rule.

- Review accounting entries and consult your tax advisor to ensure compliance and avoid penalties.

Bottom line

The FBR’s Rs. 200,000 cap on cash CoD orders represents a clear nudge toward digital payments. For merchants, it’s time to operationalize payment alternatives and customer communication. For consumers, it’s a nudge to adopt secure digital payment channels for high-value purchases. Compliance will matter — both for ease of business and to avoid complications with the tax authority. FBR Download CenterProPakistani

External links to add for authenticity (place near relevant paragraphs)

- Official FBR circular (PDF): FBR — Circular No. 02 of 2025-26 (Income Tax). FBR Download Center

- Business Recorder coverage on the limit and context. Business Recorder

- ProPakistani explainer on CoD limit. ProPakistani

- TechJuice report summarising implications for e-commerce.